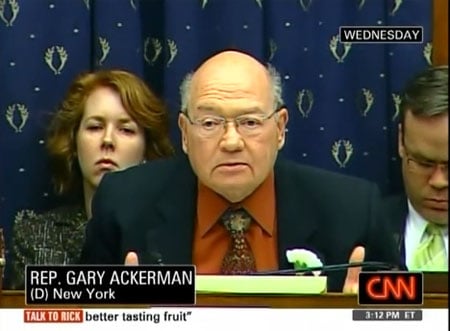

During hearings on the Bernie Madoff scandal today, Gary Ackerman unleashed on the members of the SEC for failing to protect investors and detect fraud.

Barked Ackerman: “You couldn’t find your backside with two hands if the lights were on!”

Watch it, AFTER THE JUMP…